But you can estimate your payment using today’s average mortgage rates. Note: You likely won’t know the exact interest rate until you’re close to closing and you lock a rate in. Those include home price, down payment, interest rate, and your projected taxes and insurance costs. To calculate your mortgage payment using a mortgage calculator, you’ll need to input details about your loan. How do you calculate a mortgage payment on a calculator? Keep in mind that mortgage rates have risen since 2021, and higher mortgage rates lead to higher monthly payments on average. It did not factor in other monthly costs like property taxes, insurance, and HOA dues. That was the average principal and interest (P&A) payment for a mortgage loan. How much is a typical mortgage payment?Ī typical mortgage payment was under $1,000 per month in 2021, according to CoreLogic. Use the “By Income” tab on our mortgage calculator to see exactly how much house you can afford based on your income, down payment, and current interest rates. You can also afford a more expensive house the lower your mortgage rate is. Primarily: your income, current debts, credit score, and how much you’ve saved for a down payment. How much house you can afford depends on a number of factors. Mortgage calculator Q&A How much house can I afford? Also check out other calculators by The Mortgage Reports: However, conventional is not the best loan type for everyone. This calculator assumes a conventional loan offered by Fannie Mae or Freddie Mac. Many buyers are eligible, but don’t know it yet.

#Mortgage rates nyc calculator full

These are general guidelines, however, and home shoppers should get a full qualification check and pre-approval letter from a lender. A home that meets the lender’s property standards.1-2 years of consistent employment history (most likely 2 years if self-employed).A debt-to-income ratio of 43% or less (higher DTI acceptable with compensating factors).Mortgage loans are typically available to those who meet the following qualifications: See today’s mortgage rates, JMortgage eligibility

Leaving nothing to chance, it allows you to estimate all parts of your future home payment. To arrive at this number, home buyers must use a mortgage payment calculator that includes things like private mortgage insurance (PMI), property taxes, homeowners insurance, HOA dues, and other costs.

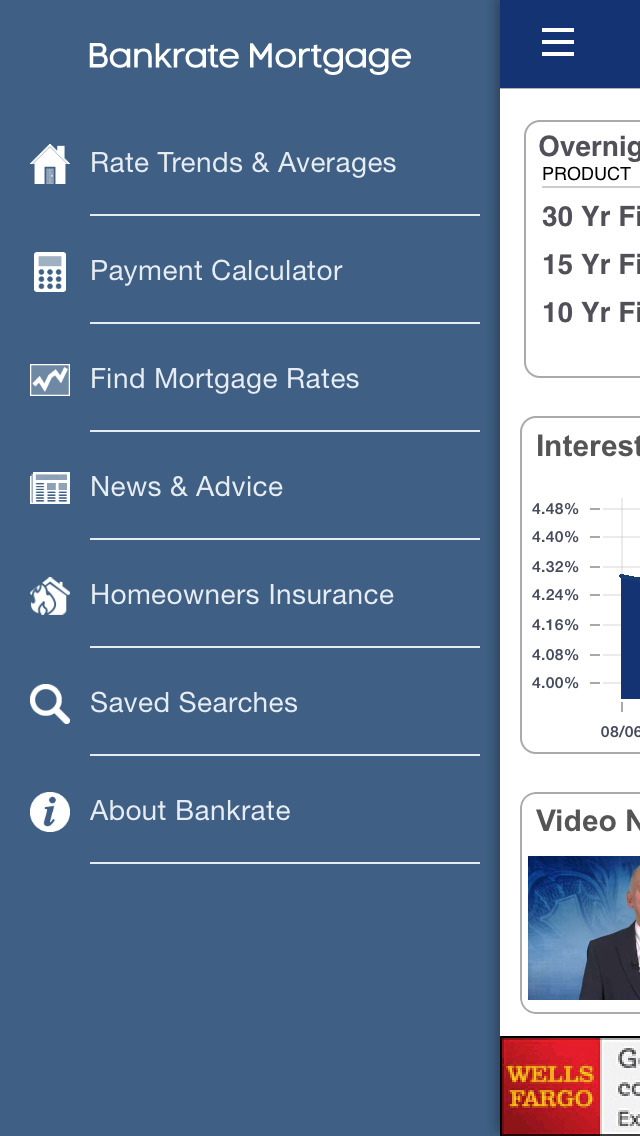

Mortgage calculators are useful - but not if they don’t tell you how much your true home payment will be. Broadview FCU NMLS Identifier: 458314.Mortgage Payment Calculator with PMI, Taxes, Insurance & HOA Dues

HOA address: 4 Winners Circle, Suite 201, Albany NY, 12205. Both are Licensed Mortgage Bankers – NYS Dept. Mortgage products in New York State only and offered by our Mortgage Teams, Homeowners Advantage (HOA) and SEFCU Mortgage Services (SMS), which are subsidiaries of Broadview FCU.

If an escrow account is required or requested, that payment does not include insurance and taxes and the payment may be greater. Rates are based on a purchase or no cash out refinance, cash out options may affect your rate. Quoted rates may include the requirement of credit union membership at the time of loan disbursal and selection of our Automatic Payment Plan. Rates are accurate as of and are subject to change without notice. Representative payment for 10/6 ARM at 4.25% with a 5.580% APR is $5.73 per $1,000 borrowed for the first 10 years then subject to increase. Representative payment for a 30 year fixed mortgage at 6.000% with a 6.149% APR is $6.09 per $1,000 borrowed. All rates quoted are the lowest available rates, actual interest rate will be based on overall credit worthiness.

0 kommentar(er)

0 kommentar(er)